Designing a unified portal for AIF Distributors and Fund Administrators to manage client portfolios, fund communications, and sales operations.

About 360 ONE Asset

360 ONE Asset manages a wide range of Alternative Investment Funds (AIFs), distributed through its network of 360 ONE Wealth Distributors across India. These distributors are responsible for engaging clients, raising commitments, and ensuring fund drawdowns are completed on time. However, much of this process—right from tracking distributor earnings to managing client-specific drawdown letters—was handled manually, through emails and Excel sheets.

PROJECT OVERVIEW

Product Design

Multiple Stakeholders: PMs, Engineers, Admin, Designers

Primary Problem Statement

A motivated distributor needs a single, reliable source of truth for their clients' performance and critical fund communications because they feel unprepared and unprofessional when manual delays and a lack of data visibility keep them from giving their clients immediate, accurate answers, ultimately eroding trust and slowing new sales.

Secondary (Admin) Problem Statement:

An operations admin needs to manage communications and track distributor performance from one central place because they can't effectively scale the business if they are spending all their time on manual tasks instead of analyzing and supporting their top-performing partners.

Problem Breakdown

The absence of a centralised platform created several operational bottlenecks:

Distributors lacked real-time visibility into client-wise earnings and fund performance.

The process of receiving drawdown letters was manual, time-consuming, and prone to delays.

The admin team had no easy way to distribute critical updates, upload documents, or track top-performing distributors.

As business scaled, these inefficiencies limited transparency, delayed communication, and made it difficult to assess which distributors were truly driving fund sales.

The Opportunity

The 360 ONE Asset team saw an opportunity to digitise and streamline the distribution process — to make distributor performance, client drawdowns, and fund-related communication accessible through a single, seamless platform.

Goals & Success Metrics

The vision for the platform was built around three clear goals:

Empower distributors with a single window to view their AIF earnings, top clients, and drawdown history.

Enable the admin team to efficiently upload, manage, and share documents like drawdown letters, AIF statements, and event/webinar content.

Track distribution efficiency — helping 360 ONE Asset identify high-performing distributors and better understand client-level investment potential.

Solution Hypothesis

We hypothesised that a unified Distributor Platform could streamline the distributor experience and improve operational efficiency for the 360 ONE Asset team. By centralizing earnings, drawdowns, and client-level insights, the platform would enable distributors to independently track their business performance and access fund-related documents in real time.

On the admin side, digitizing document management and communication workflows would reduce manual dependencies, minimize turnaround time, and establish a single source of truth for AIF distribution data.

We believed that increased transparency and data visibility would not only improve distributor engagement but also allow the Asset team to identify top-performing partners, strengthen relationships, and scale AIF sales more strategically.

Project Timeline

DISCOVERY

01

Research Hat

The first meeting

The discovery phase began in May 2025, when the idea of building a unified distributor platform was first discussed. The concept started vaguely — “a place where distributors could track their clients’ investments across MF, PMS, and AIFs.”

Designers, product managers, engineers, and stakeholders from the Asset Team sat together with the EVP – Technology, who walked the team through how various internal units collaborate to manage funds and where distributors fit within this ecosystem.

The meeting surfaced a clear business need: distributors were critical to funds growth, yet had little visibility into their own performance or access to client-specific data and fund documents.

Stakeholder Interviews

Because direct access to distributors wasn’t feasible, the design and product teams relied on domain SMEs from the AMC team, who interact with distributors daily. Through detailed sessions, the team learned how:

Distributors currently manage client and earnings data through scattered Excel sheets.

Communication between AMCs and distributors happens largely over email, leading to lost documents and inconsistent updates.

Manual record-keeping and fragmented data made it hard to identify high-performing clients or track month-on-month earnings.

Initial business requirements and scoping of the project

Internal observation sessions further clarified the scope. Guided by SMEs and early discussions, the first-phase roadmap defined the following core requirements:

Agentic Chat on the dashboard to help distributors query data and documents quickly.

Performance KPIs such as Total AUM, Earnings to date, Active Clients, Redemptions, and Drawdowns.

Celebrations Section highlighting birthdays or anniversaries.

Today’s Actionable to focus on pending tasks.

Product Switcher allowing movement between AIFs, PMS, and MF views.

02

Empathising with users to get key Insights

Distributors struggled to maintain accurate records of client-wise and scheme-wise data.

Tracking earnings and redemptions month-on-month was manual and error-prone.

Drawdown letters and reports were exchanged through long email threads, often delayed.

Important AMC events and webinars were frequently missed due to poor communication channels.

Distributor Empathy Mapping based on the information gathered

EXECUTION

Shaping the Experience

Design Direction & Information Architecture

Grounded in business priorities and SME-led requirements, the team began defining the structure of the platform. The core idea was to create a central dashboard that would serve as the single point of interaction for distributors to access their earnings, drawdowns, and client-level details.

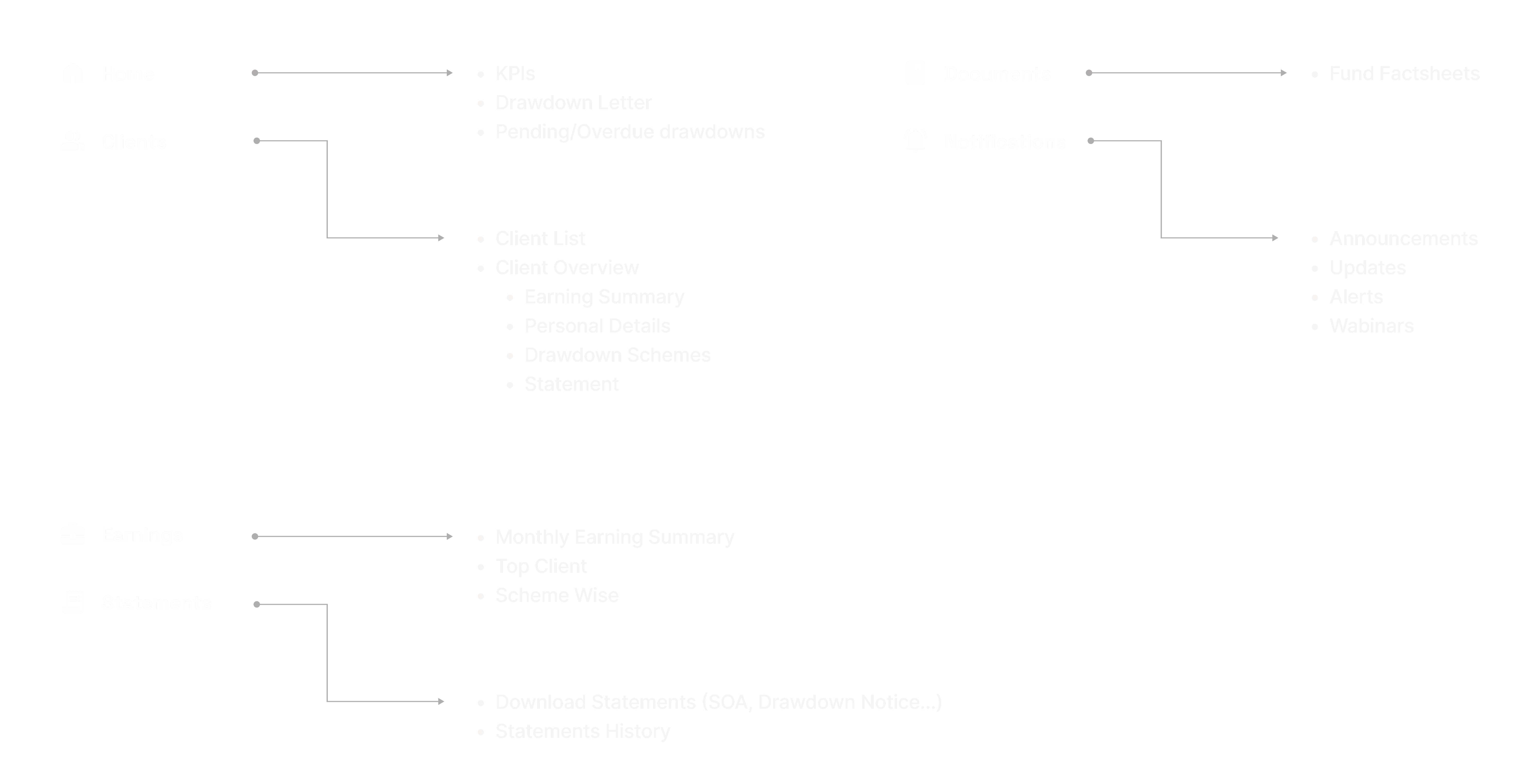

The initial IA, shaped through requirement-gathering sessions with the business and product teams, included:

Agentic Chat on the dashboard to help distributors query data or documents quickly.

Performance KPIs covering Total AUM, Total Earnings, and Total Clients, alongside data for drawdowns—categorised as upcoming, ongoing, and pending.

Redemptions & Today’s Actionables to keep distributors informed of tasks requiring immediate attention.

Celebrations Section highlighting client birthdays and anniversaries for relationship touchpoints.

Product Switcher enabling future transitions between AIFs, PMS, and MFs.

Client Details & Statement Access providing a snapshot of client-level performance and downloadable statements.

These sections were prioritised based on both data availability and business impact, ensuring a meaningful MVP that could later scale to include PMS and MF products.

Dashboard Design Approach

Since this platform was designed exclusively for funds managed by 360 ONE Asset, much of the manual workflow already existed through emails between the admin and distributor teams. The goal of the first release was to bring those workflows into a digital, structured interface.

The business team provided the initial wireframes to communicate their vision, which the design team converted into low-fidelity dashboard concepts for quick stakeholder review.

For the MVP, all stakeholders aligned on a focused KPI set — Total AUM, Total Earnings, Total Clients, and Drawdowns (upcoming, ongoing, pending) — providing distributors with instant visibility into their performance.

Rapid prototyping proved pivotal here. It allowed faster stakeholder validation, quick feedback loops, and helped the design team move from concept to alignment in a matter of days instead of weeks.

The first wireframes — shared by the PM on 3 June 2025 in Excel format — formed the base for low-fidelity screens, which were iterated multiple times based on stakeholder feedback, engineering feasibility, and data limitations.

Document Management & Drawdowns

Before this platform, all distributor documents and drawdown letters were shared manually over email, with no centralized visibility for either party. Each distributor maintained their own record system, making it difficult for the Asset team to track document dissemination or ensure consistency.

The new platform introduced a streamlined document layer:

Admins could upload drawdown letters, fund briefs, and investor documents directly to the portal.

Distributors could access, filter, and download these documents instantly, eliminating the dependency on email chains.

Built-in tagging and version control ensured distributors always saw the latest document.

This not only improved efficiency but also reduced operational overhead and data redundancy.

Design System & Visual Decisions

The design and engineering teams built the platform using components and tokens from ONE Design System v2, ensuring consistency, scalability, and faster development. Leveraging a shared design language across products allowed designers, developers, and stakeholders to speak the same visual and functional vocabulary.

Given its B2B context, the team intentionally maintained visual parity with existing 360 ONE enterprise platforms — adhering to established typography, grid systems, and component patterns. This made the product immediately familiar and intuitive for users already using internal 360 ONE tools.

Initial low-fidelity designs concepts for the platform

Iterations & Trade-offs

As the roadmap evolved, the business team prioritized AIFs as the focus for the first release, postponing PMS and MF modules to future phases. This decision refined the scope, allowing the team to double down on AIF-specific workflows such as drawdown visibility and document release cycles.

However, a few planned features were deferred due to technical and data constraints:

The Agentic Chat bot, envisioned as a conversational help assistant, was parked for future development due to limited backend data and integration feasibility.

The Product Switcher for toggling between AIF, PMS, and MF views was removed from V1, given the lack of unified data architecture across products.

These trade-offs ensured focus, enabling a stable, functional, and data-ready MVP that laid the groundwork for subsequent releases.

FINDINGS

AIF Platform

Feature Prioritisation through Iterations

After multiple stakeholder discussions, design reviews, and feasibility iterations, the platform’s focus areas were refined to deliver maximum value to AIF distributors in the first release.

Each sticky note represents a core functional area finalised for the MVP—ensuring both distributor efficiency and admin visibility.

The AIF workflow

How Data flows between distributors and 360 ONE Asset

Turning distributor pain points into clear design goals

2 Platforms; one for distributors and other for admin

Exploration for the experience of distributor platform design

With rapid prototyping and iteration, we got closer to understanding our users and refining the AIF experience

KEY SCREENS

Distributor Platform Experience

Homepage